Business

Five manufacturers’ export sales rise 37% to N17bn

Five major manufacturers in the consumer goods industry saw their export sales rise by 37 percent last year largely on the back of the liberalisation of the foreign exchange regime.

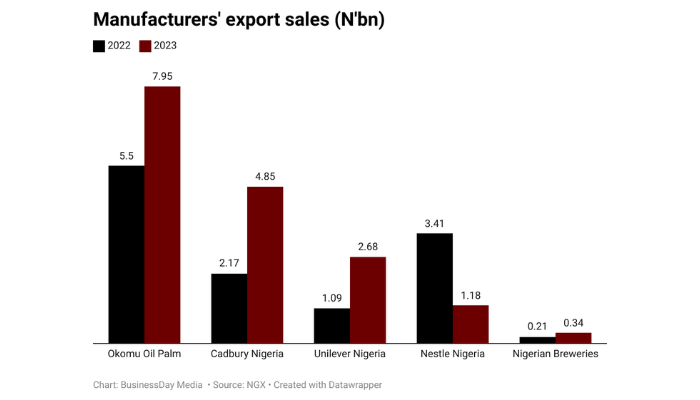

BusinessDay analysis of the latest financial statements of Nigerian Breweries Plc, Nestle Nigeria Plc, Unilever Nigeria Plc, Cadbury Nigeria Plc, and Okomu Oil Palm Plc shows that their combined export revenue increased to N16.99 billion from N12.38 billion in 2022.

Unilever recorded the highest growth in export sales of 145.9 percent growth, followed by Cadbury, 123.5 percent; Nigerian Breweries, 59.2 percent; and Okomu Oil Palm, 44.5 percent.

“The increase we are seeing in exports is a natural consequence of the devaluation that occurred for other reasons or factors, not deliberately caused by the government to increase exports,” Gabriel Idahosa, president and chairman of the council of Lagos Chamber of Commerce and Industry, said.

He said countries often devalue their currencies to boost exports. “But in Nigeria, it is not a deliberate policy decision to devalue the currency to increase exports.”

Paul Odunaiya, managing director/chief executive officer at Wemy Industries Limited, told BusinessDay in an interview last year that the currency depreciation was helping his business in terms of exports and that one of the African countries that the company exports to is Mali.

“The devaluation of our currency helped us to enter the market because of the CFA,” he said.

The FX reform implemented last June as part of the Federal Government’s measures to revive the economy has led to a large devaluation of the naira.

When the naira depreciated, the West African CFA franc, a legal tender in Benin, Burkina Faso, Côte d’Ivoire, Guinea-Bissau, Mali, Niger, Senegal and Togo appreciated.

This made some goods produced in Nigeria cheaper than other African countries. At the official market, the naira depreciated from 463.38/$ on June 9 to 1,435.5/$ as of February 2, 2024. The naira depreciated against the West African CFA franc from 0.76 per CFA1 on June 9 to 1.98 per CFA1 as of February 2.

“The naira devaluation is helping exporters to bring FX back into the country which means more naira for them. But you have to remember that their cost of production is increasing,” Odiri Erewa-Meggison, chairman of the Manufacturers Association of Nigeria Export Promotion Group, said.

Further findings from the statements revealed that Nestle was the only firm with a 65.4 percent decline in export revenue to N1.18 billion in 2023 from N3.41 billion in 2022.

Unilever recorded 145.9 percent growth in export revenue to N2.68 billion from N1.09 billion.

Cadbury recorded a 123.5 percent growth in export revenue to N4.85 billion from N2.17 billion and Nigerian Breweries reported a 59.2 percent increase in export revenue to N336 million from N211 million.

Okomu Oil Palm recorded a 44.5 percent increase in export revenue to N7.95 billion from N5.5 billion.