Business

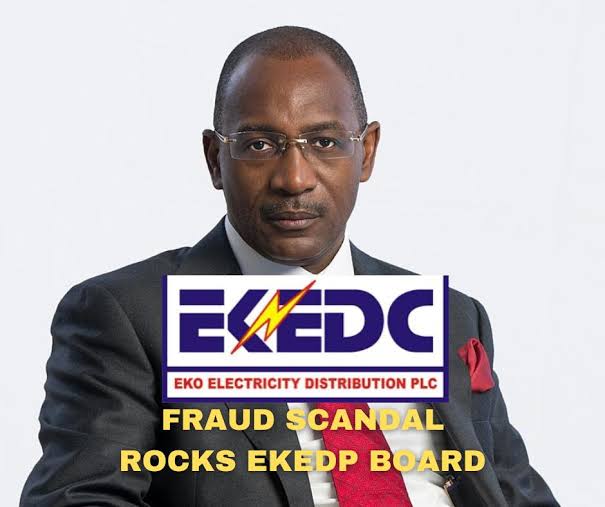

Inside Eko DisCo N100m fraud: Leaked documents reveal ghost workers, cover-up by EKEDP Chairman, Dere Otubu

The documents showed the chairman of EKEDP, Dere Otubu, in an alleged cover-up in N100 million ghost workers fraud by one Wola Condotti Joseph.

The last may have not been heard in the crisis rocking the Eko Electricity Distribution Plc (EKEDP), one of the 11 electricity distribution companies in Nigeria, as documents SaharaReporters obtained on Friday revealed a cover-up and fraud.

The documents showed the chairman of EKEDP, Dere Otubu, in an alleged cover-up in N100 million ghost workers fraud by one Wola Condotti Joseph.

SaharaReporters reported on March 26, that the Nigerian Electricity Regulatory Commission (NERC), directed the board of Eko Electricity Distribution Plc (EKEDC or EKEDP) to suspend with immediate effect all the workers of West Power and Gas Limited working with the company.

West Power & Gas Limited (WPG) is a limited liability company incorporated under the laws of the Federal Republic of Nigeria, which has a stake in EKEDP.

It says on its website that it was “established for the purpose of investing in, operating and managing electricity related business in the most reliable and professional manner for the benefit of Nigerian power consumers”.

It was reported that the directive may be connected with the recent petition by some concerned staff members of EKEDP to the Vice President, Senator Kashim Shettima; Independent Corrupt Practices and Other Related Offences Commission (ICPC), and the Economic and Financial Crimes Commission (EFCC) for intervention in the alleged endemic corruption in the management of the electricity distribution firm.

Although the company has dismissed the allegation, describing it as unfounded, the accusers have continued to push for external investigation.

However, in compliance with the directive of NERC, the Board Chairman, Otubu, directed the Managing Director/Chief Executive Officer of Eko Electricity Distribution Plc, Dr. Tinuade Sanda to leave her position, as she was also seconded from WPG.

SaharaReporters learnt that following the directive, the MD/CEO, Chief Legal Officer, Chief Finance Officer, Chief Human Resources Officer, Chief Auditor and Compliance Officer and others on secondment at the company handed over their handover notes to their subordinates as directed.

Thereafter, the Director, Chairman Legal & Regulatory Committee of the company, Mr. Babor Egeregor, faulted the purported removal of the Managing Director and Chief Executive Officer of the EkoDisco, Dr Tinuade Sanda from office, insisting that she remains the EkoDisco MD/CEO.

In a rebuttal, titled: “RE: FG Sacks Eko Disco Managing Director”, Egeregor explained that there was never a time the Nigerian Electricity Regulatory Commission directed that all staff of EkoDisco on secondment should be sacked.

According to him, the decision of the NERC was misinterpreted by the Chairman of Board, Dere Otubu, for ulterior motive, adding that the NERC decision on seconded staff was only directed to those connected to the alleged fraud and negligence in the company in the name of – Wola Joseph Condotti, Sheri Adegbenro, and Aik Alenkhe.

The rebuttal partly read: “It has come to my notice that by a letter dated 26th of March 2024, the Chairman of Eko Electricity Distribution Company (EKEDC), Mr. Dere Otubu purportedly terminated the Contract of Employment of Dr. Tinuade Sanda, the MD/CEO of EKEDC, allegedly in compliance with Orders/Directives issued by the Nigerian Electricity Regulatory Commission (NERC).

“The said Order of the NERC, herein displayed, are unambiguous, incapable of, and unyielding to plural interpretations. There was nowhere in the Order where NERC requested the removal of any staff either seconded to or hired by EKEDC except those connected to the alleged fraud and negligence i.e., Wola Joseph Condotti, Sheri Adegbenro, and Aik Alenkhe.

“In fact, NERC’s directives were issued to compel the Board of EKEDC, following picketing by the Union and unrelenting Staff protests, to act appropriately in the face of a determined position of a majority of the Board members to cover up the alleged use of ghost workers together with the alleged fraud and protect Wola Joseph Condotti especially.”

It added, “Mr. Dere Otubu’s letter, therefore, was done in bad faith and in vengeful revenge against the MD/CEO for escalating the alleged fraud and issuing queries against one of his protégés, whom he has desperately swore to protect by all means. As a matter of fact, the Ag DG of the BPE, representing the Government on the Board of EKEDC, vehemently rejected the attempt to cover up the alleged crime and insisted on compliance with the punishment prescribed in the Conditions of Service.

“Rather than comply with the Orders of NERC, a recourse to subterfuge was hatched with the purported termination and the publication of different misleading headlines such as “FG Sacks MD of EKEDC”, “Tinuade Sanda relieved of her position as MD, Eko Distribution Company.”

“There are no doubts about a deliberate agenda and unconcealed mischief to misread the Orders of the NERC to malign Dr. Sanda’s reputation for daring to escalate and issue queries to Wola Joseph Condotti for alleged fraud through the use of ghost workers for 3 years, and continuous payment of salaries to exited staffs despite personally receiving their resignation letters.

“Similar queries were issued to Sheri Adegbenro, the Chief Audit and Compliance Officer and Aik Alenkhe, the Chief Human Resources Officers respectively for their failure and gross negligence to audit and detect fraudulent payments on pay roll for over 3 years.”

The emails have shown that the company’s struggles have been partly caused by a significant level of corruption going on in the organisation, which allegedly involved her – (Wola Joseph Condotti) and the chairman has been allegedly linked to aiding ghost workers in the company and earning millions of Naira from the dubious dealings.

As shown in email correspondence between the chairman of West Power & Gas Limited (WPG) George Etiom and Chairman of EkoDisco Dere Otubu.

WPG had in a letter dated December 5, 2023 which was addressed to Dene Wale and copied management of EkoDisco, recalled from the position as Chief Legal Officer (CLO) in Eko Electricity Distribution Company Plc, pending an investigation into alleged misconduct.

The Chairman of EkoDisco, Otubu challenged it and told her to ignore it, despite WPG being the employer of Wale Joseph.

The letter which was signed by George Etomi, Chairman of WPG partly read: “We received notice of the Demand for Explanation (DFE) dated 22 November 2023 issued to you by the MD/CEO of Eko Electricity Distribution Company Plc. (EKEDP), wherein allegations of misconduct and policy breaches were levelled against you in your capacity as Chief Legal Officer (CLO). We are also in receipt of your email response dated 27 November 2023 in respect of the queries raised in the said DFE.

“Given the grave nature of these allegations which carry serious legal consequences if proven, this matter has been referred to the board of directors of WPG for further action. Accordingly, we refer to your Offer of Employment dated 2nd October 2013 and hereby recall you from your position as CLO in EKEDP until our receipt of a full report following the ongoing investigation.

“In order to finalise the investigation as soon as possible with the least amount of disruption to you and WPG, you may not during this period of investigation, interfere with evidence or the investigation itself, or contact any employee or possible witnesses in connection with the investigation or any related matter.

“Furthermore, we note that you are currently on maternity leave and have handed over your responsibilities to Mrs. Ihuoma Chukwuka – Head, Company Secretariat, who acts in your capacity as CLO. We advise that the situation remain unchanged until you hear from us after the conclusion of the investigation in the coming days. Meanwhile, you will continue to receive your monthly pay and all other benefits for the duration of the investigation.

“We hope that this conveys the gravity with which we regard this matter.”

However, Dere Otubu on same Tuesday, December 5, 2023 at 9:51 am wrote to Wola to disregard the recall letter from her employer.

The email titled: “LETTER OF RECALL,” which was copied to members of EkoDisco Board of Directors, reads: “I was copied in a letter from Chairman of WPG dated 5th of Dec 2023 recalling you from the position of Chief Legal Officer to EKO DISCO.

“Kindly disregard this letter in its entirety. Eko Disco will continue with its process of looking into the matter. Eko Disco MD who is copied should note accordingly.”

However, responding to the letter directing Wola to disobey valid recall to Otubu, the Chairman of WPG George Etiom reminded Otubu that WPG is well within its rights to recall any of its staff based on the Operations and Management Agreement executed between WPG and EKEDP.

Etiom stated “I am very surprised at this turn of events because instructing the CLO to disregard a directive from the Chairman of WPG, her employer, can be considered an act of encouraging insubordination. This may easily be construed as setting a wrong precedent that could empower management staff to undermine the Directors of the Board at all levels.

“As you are aware, WPG is well within its rights to recall any of its staff based on the Operations and Management Agreement executed between WPG and EKEDP. The rights to recall and/or discipline staff are consequential rights of WPG as the CLO’s employer. The Letter of Recall to the CLO constitutes standard practice in such cases, pending the conclusion of the investigation and determination of the matter.

“Kindly be aware that the issues that have necessitated the recall are very grievous and nothing whatsoever should be done to condone or cover them up. Without prejudice to whatever action you want to take, WPG will go ahead to conduct a full investigation into the matter and I advise all our nominees on the EKEDC Board not to lend themselves to any cover up.

“The instruction to recall stands and ignoring it will be at the peril of whoever does so.”

Meanwhile, as the facts concerning the alleged misconduct and ghost workers debacle unfold, it remains how the whole crisis will end.