people

Hannatu Musawa: The insolence behind Arts Minister’s N197m Hermes bag

A virtuous woman is never moved by fashion labels and flamboyance. For her, luxury scarcely lies in nametags and ornate markers but in the absence of vulgarity. But Hannatu Musawa does not know that. If she does, she doesn’t care.

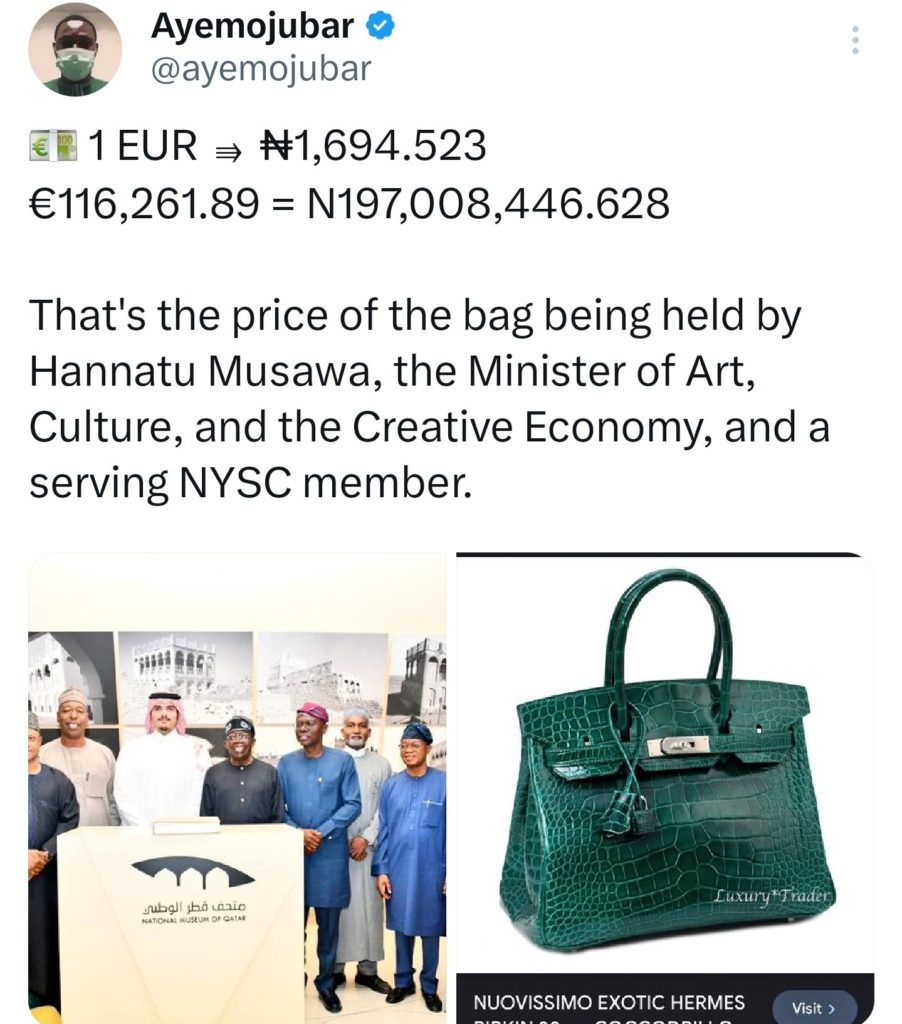

Thus her inclination to brazenly carry and flaunt a Hermes bag valued at Î116,261.89 Euros (197,008,446.628) while on a diplomatic trip with President Bola Tinubu to Qatar.

There hasn’t been any more repellent sight, several pundits averred, since Nigerians were plummeted into economic depression following President Tinubu radical surgical economics.

Nigeria’s Minister of Art, Culture and the Creative Economy Hannatu Musawa (previously deputy spokesperson for Bola Ahmed Tinubu’s campaign), does not understand perhaps how insensitive and vulgar it was to carelessly flaunt such a vulgar fashion item while many Nigerians are battling to survive the severity imposed on the country by her principal’s economic reforms.

Musawa ought to understand that only a self-centered, acquisitive woman would clad in the cloak of intransigence would carelessly flaunt such vulgar possession amid so much suffering and pain.

There is no gainsaying her action was at once deemed ugly and insensitive by diverse segments of netizens. Among other things, it brings back memories of the scandalous conduct of past female ministers, particularly former petroleum minister, Diezani Alison-Madueke.

There is no gainsaying Alison-Madueke, among others, made news for the wrong reasons. She set the pace for vulgar acquisitiveness in Nigeria’s corridors of power.

About $40 million worth of expensive jewelry was recovered from her by the Economic and Financial Crimes Commission, (EFCC).

The expensive jewelry comprising wristwatches, necklaces, bracelets, bangles, earrings and more were reasonably suspected to have been acquired with proceeds of unlawful activities of the former Minister. Some of the recovered items were listed as 125 pieces of wedding gowns, 13 pieces of small gowns, 41 pieces of waist trainers, 73 pieces of hard flower, 11 pieces of suit, 11 pieces of invisible bra, 73 pieces of veils, 30 pieces of braziers, two pieces of standing fan, 17 pieces of magic skits, six packets of blankets, one table blanket and 64 pairs of shoes.

The EFCC was granted permission by the court to seize the jewelry from Allison-Madueke after establishing that her known and provable lawful income is far less than the value of the jewelry sought to be forfeited.

Alison-Madueke, 63, served as petroleum minister from 2010 to 2015 under former President Goodluck Jonathan and also acted as OPEC president from 2014 to 2015.

She was arrested in London in October 2015, a few months after leaving office, and has also been the subject of investigations in Nigeria and the United States.

The ex-petroleum minister has denied the corruption allegations even as assets worth millions of pounds relating to her alleged offences have been frozen as part of an ongoing probe by the UK security agency.

The NCA accused her of having benefited from at least £100,000 ($127,000) in cash, chauffeur-driven cars, flights on private jets, and gifts from designer shops such as Cartier jewellery and Louis Vuitton goods, to mention a few.

The US Department of Justice also recovered illicit assets totalling $53.1 million linked to Alison-Madueke in March 2023. Nigeria’s EFCC claimed that about $153 million and more than 80 properties had been recovered from Alison-Madueke.

In August 2023, British police charged Alison-Madueke with bribery offences.

“We suspect Diezani Alison-Madueke abused her power in Nigeria and accepted financial rewards for awarding multi-million-pound contracts. These charges are a milestone in a thorough and complex international investigation,” said Andy Kelly, Head of the National Crime Agency’s (NCA) International Corruption Unit.

It would be really nice if Musawa could learn from the sad fate of

Allison-Madueke; the latter was equally known by her lust for expensive jewelry and bags.

Already, Nigerians are critical of her performance as she made the news recently for bungling a rare opportunity to put the country on the global map of culture and entertainment industry.

No thanks to Musawa, the National Academy of Recording Arts and Sciences (commonly known as The Recording Academy) held off its announcement of the creation of an African edition of the Grammy Awards and of several hubs throughout Africa. The announcement was initially supposed to happen after the 66th awards ceremony held in Los Angeles on February 4, but was cancelled after Nigeria’s sudden about-face.

Lagos is one of five cities selected by the prestigious American academy to be a regional hub, along with Johannesburg, Nairobi, Kigali and Abidjan (AI, 03/11/23). However, much to the Recording Academy’s dismay, Nigeria’s Minister of Art, Culture and the Creative Economy, Musawa left LA with the contract she was supposed to submit.

Pundits contend that she was ruffled by the fact that none of the five Nigerian artists nominated for a Grammy this year – Burna Boy, Davido, Asake, Olamide and Ayra Starr – won an award. But when contacted, the ministry explained this last-minute U-turn by the absence of Ugochi Akudo-Nwosu, the director of its Entertainment and Creative Services Department.

Notwithstanding, Nigerians, particularly entertainment stakeholders in the country, are hoping that Musawa would seize the opportunity of a few days reprieve granted the country by the Academy director, Harvey Mason Jr, and send the signed contract within a few days.

More Nigerians are calling on the minister to commit herself ardently to the serious task of governance and the development of the country’s entertainment, culture, and creative economies.

These are more noble and acceptable callings that require her devotion; and while she commits to the task, let her not forget to shun the lure of obsessive passion and lust for vulgar fashion items lest she ends up like Alison-Madueke and her ilk.

people

Nigerian-American billionaire Adebayo Ogunlesi’s net worth jumps to $2.3 billion

The net worth of Nigerian-American billionaire Adebayo Ogunlesi has skyrocketed to $2.3 billion from $1.7 billion recorded on the 15th of January, one week after he was called to be a part of the OpenAI board of directors.

According to Business Insider, the staggering increase in his fortune is due to his investment portfolio, which is worth more than $1.8 billion.

The Nigerian billionaire’s appointment to OpenAI’s board comes after BlackRock and GIP signed a $12.5 billion agreement in January 2024, establishing a preeminent multi-asset infrastructure investment platform.

Under Ogunlesi’s direction, GIP grew to become the largest independent infrastructure manager in the world, managing more than $100 billion in assets.

The decision to add Ogunlesi to the OpenAI board reinforces his global reputation as a visionary leader with a track record of driving innovation and commercial success.

This portfolio encompasses investments in BlackRock, the world’s largest asset management firm, Kosmos Energy Holdings LLC, Topgolf Callaway Brands Corp., and Goldman Sachs Group. Ogunlesi’s exceptional wealth increase demonstrates his strategic investing aptitude.

By owning holdings in significant global corporations, he has established himself as one of Africa’s most powerful corporate figures.

His investments in industries ranging from asset management to energy and leisure have proven to be quite profitable, demonstrating the importance of a well-diversified portfolio. In 2024, he was one of the three Nigerians who made Forbes’ 50 Wealthiest Black Americans list.

people

END OF CONTROVERSIES! Governor Makinde appoints Owoade as new Alaafin of Oyo

Governor Seyi Makinde of Oyo State has approved the appointment of Prince Abimbola Akeem Owoade as the new Alaafin of Oyo.

This was disclosed in a statement by the commissioner for Information and Orientation, Prince Dotun Oyelade, on Friday.

While speaking on behalf of the governor, Oyelade said that Owoade, after thorough consultations and divinations, has been recommended by the Oyomesi.

“Prince Abimbola Akeem Owoade, after thorough consultations and divinations, has been recommended by the Oyomesi and approved by Governor Seyi Makinde as the new Alaafin of Oyo,” the statement read.

He said the announcement ends the legal and social disputes that followed the passing of the former Alaafin, Oba Lamidi Adeyemi III, who died on April 22, 2022.

Meanwhile, the commissioner for Local Government and Chieftaincy Affairs, Hon. Ademola Ojo, urged the people of Oyo to lend their support to the new Alaafin.

“This decision has put to rest all the socio-legal controversies that have arisen since the transition of the late Oba Adeyemi. We urge the people of Oyo State to support the new Alaafin and join the government in celebrating this historic moment,” he said.

people

House of Reps Member bags prestigious chieftaincy title

Chairman of the House Committee on IDP, Refugee, and Migrant Affairs, Hon. Tunji Olawuyi, on Saturday, bagged prestigious Chieftaincy title of Akinrogun of Ayedun Kingdom by HRM Oba Dr. Olusegun Abayomi Rotimi, the Obajisun of Ayedun Kingdom.

The title was conferred on him by Obajisun kingdom at a grand reception organized in his honor as a politician who has contributed immensely to the development of his constituency and beyond. Ajuloopin is known for his commitment at the grassroots level impacting the less privileged and ensuring adequate human nurtures.

In his remark on Facebook post, the federal lawmaker appreciates the Ayedun kingdom for such unprecedented honour.

people

‘She touched my nipples’ – Details of how man slept with mother-in-law on wedding night

It was a twosome night for Mr. Eket, who traveled from Canada to marry one of the prettiest ladies in the world. But arriving in Nigeria to have a colorful wedding day and perfect marriage, his mother-in-law tasted his perfect manhood on his wedding night.

Here is my story:

“It didn’t just happen on my wedding night, the romance started when I was in Canada. I met Chika online, we got to know each other within a year and our relationship started well, as time went on I came back to Nigeria for a holiday, and I went to her house where I met her mum and other siblings. Her mum is a single mother and is very beautiful like my wife. To cut a long story short, I slept in their house that very day to familiarise myself with the family because of the way I was welcomed. Trust me, in the night my mother put on net nightwear, fully transparent, she came into the sitting room while her daughter went to get something outside the house. I melted. Her boobs were still very standing and sexy, and she went straight to her bar to pick alcoholic wine, turning her back was awesome, my manhood couldn’t withstand such pressure but I was able to control myself.

‘Why I like to have raw s3x’ – Ghanaian rapper reveals reasons for ‘no condom’

I had a good night in that house after playing with my fiancee we both slept together and the following morning I went back to my house and told my friend what happened. In a few days, I returned to Canada, and my relationship with Chika went deeper, talking on the phone and we started planning the wedding. But there was a day my mother-in-law called me on video but I missed it. The following morning I called back, but she declined. I later sent her a message that I missed her call she it was a mistake.

Another day, she called on WhatsApp video and I picked it up, what I saw was bad, she didn’t put her face to the Camera, I saw her standing nipples, but I must confess that she had good body skin, even at her 50s she still having it glowing. I said Mummy you are video call but she didn’t reply and I didn’t hear any voice I saw her lying down facing the camera but her face not showing. I cut the video but I couldn’t tell my fiancee. I told my friends and they went on to check her on Facebook to know who she was. My friends came back to tell me, you are going to marry two wives same day, they were joking because of her beauty.

Trump: ‘U.S visa issuance will be tough’ – American universities warn Nigerians

Fast forward to my wedding night, my wife and her friends had drunk, she was tired and slept off tirelessly in the bed. We are just five at home that night because of privacy. My mother-in-law, my wife, house help, and one person from my own family. I was in the store checking how some things were fixed improperly, I wore a singlet and boxer, and she wore that same net with wrapper. She was with Hennessy and a glass cup, she was looking intoxicated. She looked into my eyes and said Eket, thank you for all you have done for my daughter, the next thing, she stretches her hand to my chest, twisting my nipples, I told her mum what, and the next thing she grabbed my manhood, I must confess to you that I open my mouth to her standing boobs, and we started having it from back.

It was that day she told me, she was not the biological mother of Chika. But after that night, we had it two more times before she relocated to Luxembourg permanently. A few months later, I asked Chika how to visit her in Luxembourg, and that was when she told me, that the woman was just her street area mother that they were not related, and that she was from Imo State while Chika was from Anambra State.

Today, we are blessed with three kids but Chika never knew what happened between me and her area mother.

people

REVEALED: Top 10 richest people in the world in 2024, and nine are Americans

When Forbes released its annual list of the richest people in the world earlier in 2024, it noted that the number of billionaires had climbed to its highest ever at 2,781. Cut to the end of the year and it is quite clear that the number of billionaires in 2025 will rise even further. A snapshot of what is to come can be seen from the impeccable rise in the fortunes of the 10 richest billionaires in the world as of December 2024, most particularly Elon Musk.

It is worth noting that while the first half of the year may not have been outstanding for most, the latter half turned out to be remarkably different, particularly due to the outcome of the US Presidential elections.

As Donald Trump emerged victorious on 5 November, the world’s 10 richest billionaires added a massive USD 64 billion in a single day to their cumulative net worth. The biggest gainer was, of course, Elon Musk, who added USD 26.5 billion following Trump’s win.

While a handful, maybe one or two at most, of the 10 richest billionaires might see their net worth fall over the next few weeks due to volatility in the markets owing to a series of political factors in the world, most of them will remain on the list.

It is also not a surprise that nine of the top 10 billionaires of 2024 are from the United States. The US is like a modern-day Roman empire, where wealth creation – by any means necessary – is the cornerstone of its societal and governmental policies, and, therefore, the foundation upon which it stands. This is why they had a record 813 billionaires earlier in the year, as Forbes data revealed. (Though Hurun Global Rich List 2024, released around the same time, suggested China has more.) Obviously, that number will go up in the 2025 list.

It is also noteworthy that most American billionaires are now richer than they were a year prior, irrespective of issues such as inflation, wars and political unrest affecting almost all of the world in 2024. Whether anyone likes it or not, the re-election of Trump has strongly boosted the confidence of investors in the US markets at least for the time being. There are clear indications that the mega businesses of the US, especially the semiconductor and broader tech enterprises with focus on artificial intelligence (AI), may see themselves expand massively.

(Note: Data on net worth, age, nationality and source from Forbes Real-Time Billionaires chart as of 17 December 2024.)

Here are the world’s 10 richest billionaires of 2024

Michael Dell

Net worth: Around USD 121 billion

Age: 59

Nationality: United States

The chairman and CEO of Dell Technologies has doubled his net worth since 2023. Dell founded his namesake computer company in 1984. The world-renowned company is one of the leading manufacturers of personal computers. In 2016, Dell acquired computer storage giant EMC to become Dell Technologies. Thus, Dell and Dell EMC are subsidiaries of Dell Technologies.

According to a 2023 Forbes report Michael Dell holds a 50 per cent stake in Dell Technologies. He also has a 40 per cent stake in American cloud computing company VMware and has a private investment firm, DFO Management. At the time, around 75 per cent of his then USD 66 billion net worth came from his shares in Dell and VMware. In November 2023, American semiconductor maker Broadcom acquired VMware for USD 69 billion. Michael Dell received cash and shares in Broadcom in exchange for his stake in VMware.

That deal is the reason why he became one of the top 10 wealthiest billionaires in mid-December of 2024. Dell owns 210 million shares in Broadcom. The value of his holdings rose as the company’s stocks skyrocketed and its market cap crossed USD 1 trillion.

Steve Ballmer

Net worth: Around USD 131 billion

Source: Microsoft

Age: 68

Nationality: United States

His net worth may go north or south, but nothing will take away the fact that Steve Ballmer has achieved something rare in the world of business in 2024 — surpassing the wealth of a founder of the very company in which he worked as an employee.

In June 2024, Ballmer became the sixth-richest person in the world with a net worth of USD 157 billion. He is still the only person in the world with a net worth of more than USD 100 billion who has earned his fortune as an employee and not as a founder. By comparison, Bill Gates, who co-founded Microsoft, has a net worth of USD 108 billion and is ranked 14th on Forbes‘ real-time billionaires as of 9 December 2024.

Ballmer, the employee No.30 of Microsoft, holds roughly 4 per cent stocks in the company, which is the world’s third-biggest by market cap with an estimated worth of USD 3.2 trillion. He succeeded Gates as Microsoft’s CEO in 2000 and remained in the position till in 2014. The same year he bought the National Basketball Association (NBA) team Los Angeles Clippers for USD 2 billion. The team is now worth an estimated USD 5.5 billion.

Warren Buffett

Net worth: Around USD 142 billion

Age: 94

Nationality: United States

The “Oracle of Omaha”, Warren Buffett is the oldest billionaire among the top 10 richest people in the world by net worth. Buffett is a kind of a czar among stock market enthusiasts; investors keep a keen eye on what the nonagenarian is trading in, as it can give them clear indications as to what may or may not perform in the long run.

For three straight quarters in 2024, Buffett, through his holding company Berkshire Hathaway, maintained a steady retreat from the stock markets. By early November 2024, Berkshire Hathaway had around USD 325 billion in cash. Yet Buffett’s net worth rose by more than USD 8 billion on the back of Berkshire Hathaway’s A share stock price rising by around 7 per cent in November.

A September 2024 Forbes report gives greater insight into Berkshire Hathaway’s portfolio. According to it, its five biggest investments include Apple, American Express Company, Bank of America, Coca-Cola and Chevron. Berkshire Hathaway also wholly owns several prominent companies. Among them are insurance company GEICO, freight railroad company BNSF Railway, battery maker Duracell and fast-food chain Dairy Queen.

Buffett is one of the world’s most famous philanthropists. He has promised to give away 99 per cent of his wealth and has donated around USD 60 billion to date, much of which has been through the foundations of his children and the Bill & Melinda Gates Foundation.

Sergey Brin

Net worth: Around USD 154.5 billion

Age: 51

Nationality: United States

Sergey Brin, the son of a mathematician father, escaped the Soviet Union at the age of six with his family. He met Larry Page while pursuing a doctorate at Stanford University. Soon the two friends dropped out and founded a search engine named Google from a friend’s garage in 1998. The rest is perhaps the greatest story in the world of technology.

The company went public in 2004 and is now a subsidiary of Alphabet — a holding company created by Brin and Page in 2015. Alphabet is the fifth biggest in the world with a market cap of over USD 2.1 trillion. YouTube is also part of Alphabet as it was acquired by Google in 2006. Advertisement company DoubleClick, AI company Deepmind, wearable fitness device maker Fitbit and satellite navigation provider Waze are among Alphabet’s key acquisitions.

Brin served as the president of Alphabet till 2019. He has a controlling stake in the company. According to Nasdaq, Brin and Page own a 6 per cent stake in the company. This means that Brin has a share of 3 per cent.

Brin also has investments in other companies. A notable one was electric car maker Tesla, in which he invested in 2006 — two years before Elon Musk became its CEO. In 2021, reports said that he had sold all of his Tesla shares for USD 366 million. He has also invested around USD 250 million into his aerospace research company LTA Research, which is building high-tech airships.

Larry Page

Net worth: Around USD 162 billion

Age: 51

Nationality: United States

The other half of the Google co-founder duo, Larry Page stepped down as CEO of Alphabet in 2019 but remains on its board and is a controlling shareholder. His fortune almost doubled through 2020 and 2021, quite like several other top 10 billionaires at the time, during the pandemic. Like Brin, Page owns around 3 per cent of Alphabet.

Bernard Arnault & family

Net worth: USD 171 billion

Age: 75

Nationality: France

The only non-American among the 10 richest people, Bernard Arnault was the richest person in the world in Forbes’ annual billionaires list in 2023 and 2024. He had a net worth of USD 233 billion in the latter list. But the chairman and CEO of French luxury goods giant LVMH Moët Hennessy Louis Vuitton, who until March 2024 held on to his place, has since seen his net worth fall by several billions.

Weaker sales in China resulted in the conglomerate’s stock prices tanking by 20 per cent in six months. Fortune reported in September 2024 that the drop in stock price resulted in Arnault finding his net worth slashed by USD 54 billion. According to Forbes’ estimates, he lost USD 9 billion in November alone as shares of LVMH fell by 6 per cent.

Arnault owns around 48 per cent of LVMH. His holding company, Agache, controls Financière Agache. They back Aglaé Ventures, a venture capital firm which has investments in Netflix (whose co-founder, Reed Hastings, is also a billionaire) as well as TikTok’s parent ByteDance. In November 2024, Agache became a majority shareholder of the Ligue 2 football team Paris FC with a stake of 52.4 per cent.

With LVMH, Arnault also has a 40 per cent stake in private equity firm L Catterton. The firm, which was founded in 1989, has under its management USD 34 billion worth of assets around the world. Among its investments in Asia are China’s Trendy International Group, India’s PVR Cinemas, Singapore’s Charles & Keith, and South Korean luxury eyewear major Gentle Monster whose client list includes entertainment icons such as Beyoncé, Rihanna, Kendrick Lamar, Billie Eilish, and Jennie of BLACKPINK.

Mark Zuckerberg

Net worth: USD 216 billion

Age: 40

Nationality: United States

The youngest billionaire among the top 10 of 2024, Mark Zuckerberg leads the world’s largest social media company as its CEO. The story of how he co-founded Facebook (now Meta Platforms) as a 19-year-old student of Harvard University in 2004 has been retold umpteen times and recounted in the biographical movie The Social Network (2010).

Musk, who currently owns around 13 per cent of his company’s stocks, first entered the top 10 on Forbes billionaires list in 2016 with a net worth of USD 44.6 billion. He has been among the top 10 in all successive years barring 2022 and 2023. Between 2023 and 2024, his net worth increased by more than USD 112 billion, returning him among the top 10 in Forbes’ 2024 list.

In October 2024, he entered the exclusive list of billionaires with a net worth of more than USD 200 billion — the first time that Forbes had four people with a similar or higher net worth. He is now worth more, which means Zuckerberg will certainly be among the 10 richest billionaires in the world when Forbes releases its 2025 list.

Larry Ellison

Net worth: Around 217 billion

Age: 80

Nationality: United States

While the meteoric rise in the net worth of Jensen Huang has been the talk of the town since 2023, the one who perhaps went under the radar despite the phenomenal gains he made is Larry Ellison.

Until 2020, Ellison, the chairman, chief technology officer and co-founder of software giant Oracle, was far from any top 10 richest persons list. At the time his fortune was somewhere around USD 60 billion. But today, it is more than 280 per cent what it was just over four years ago. In fact, Ellison and Bezos have been engaged in a close contest for the No.2 spot among the world’s richest persons for quite some time in 2024, till as recently as 1 December, when the former was behind only Musk.

So, how did Ellison manage this astonishing rise and end up becoming one of the 10 richest billionaires of 2024? The short answer is AI. Oracle is now a major driver of the AI boom and has partnered with Huang’s NVIDIA in key areas. Oracle is also a major player in cloud computing and services. Its stocks have risen by as much as 64 per cent in 2024 alone. This directly increases Ellison’s net worth, since he owns 40 per cent of the company.

Ellison also owns somewhere around 1.4 per cent of Tesla stocks. He was on the board of the electric car major from 2018 till August 2022, the period after which his shareholding information has not been disclosed.

Jeff Bezos

Net worth: Around USD 246 billion

Age: 60

Nationality: United States

The chairman of Amazon, Jeff Bezos gained around USD 19 billion in November due to an 11 per cent rise in the shares of his e-commerce behemoth. Unlike Musk, however, Bezos has seen more stability in his fortune in the long run.

Forbes notes that Bezos’ director to The Washington Post, the prestigious media house he owns, not to endorse a presidential candidate ahead of the 2024 US Presidential elections led to a loss of “a couple hundred thousand subscribers”. But the loss is insignificant to Bezos as The Washington Post itself has been struggling financially for months, according to multiple media reports.

At the time of his divorce with ex-wife MacKenzie Scott, he retained 12 per cent of Amazon’s shares and she got 4 per cent. Today, he holds 10 per cent of Amazon.

Bezos was the world’s richest person for four consecutive years on Forbes’ list of the world’s billionaires from 2018 through 2021. He was the third richest person in Forbes’ 2024 list and seems to be ready to become the second-richest in the 2025 list. However, as of the end of December, the gap in the wealth between him and the richest man, Musk, is more than USD 200 billion. That’s a titanic difference because the figure alone is more than the net worth of anyone after Zuckerberg, the fourth-richest person.

Elon Musk

Net worth: Around USD 454.5 billion

Age: 53

Nationality: United States

Elon Musk was undoubtedly the biggest gainer in the business world when Donald Trump won a decisive mandate in the 2024 US Presidential elections. In fact, it needs no ‘analysis’ to underline the gains Musk made after the results showed Trump securing his place as the 47th President of the US.

Musk has always been very vocal about his support for the Republican leader and donated somewhere between USD 100 million to USD 260 million to the Trump campaign. Now, he has been named the co-head of an advisory group Department of Government Efficiency (DOGE) along with Vivek Ramaswamy.

As for his wealth, his fortune saw a rise of 25 per cent in November alone and crossed USD 300 billion for the first time in two years. Forbes estimates that his net worth increased by USD 66 billion between 1 November and 1 December. This is the clearest indicator of the significance of Trump’s victory on Musk’s fortune.

Musk was the world’s richest person in 2023 and will end 2024 as the richest of all billionaires. He had lost his spot briefly between January and May 2024, but xAI’s valuation over the next few months helped him back up. The South African-origin tech genius owns 54 per cent of the USD 50 billion company, according to Forbes. His primary source of wealth is Tesla, in which he holds a 13 per cent stake. Apart from Tesla and xAI, the major companies owned by Musk include SpaceX, The Boring Company, Tesla Energy and Neuralink.

As of 9 December 2024, he had a net worth of USD 355 billion. By 11 December, just about two days later, he became the first person in history to clock a net worth of USD 400 billion largely due to a jump in SpaceX’s valuation to around USD 350 billion. To put this into perspective, Musk’s net worth is more than the nominal GDPs of several Asian and European economic powerhouses and oil-rich Gulf countries, including Malaysia, Hong Kong, Denmark, Finland, Qatar and Kuwait.

Source: www.lifestyleasia.com

people

Ex-Zenith Bank GM, Bukky Latunji buries mother in grand style (PHOTOS)

Mother’s love is so strong that cannot be quantified with anything, this is what was displayed during the final joining home of Mrs. Olufunmilayo Christiana Latunji, mother of Ex-Zenith General Manager, Ms Bukky Latunji.

Mrs. Funmilayo Latunji, who slept in the Lord on Sunday, October 13, 2024, at the age of 83.

The joining home for Mama Latuji began on Wednesday, November, 27th with Service of song, at the Holy Trinity Anglican Church, Ikate, Surulere, Lagos. Followed by Wake-keep on December 4th, at the Prestigious Eko Club, Blessing Hall, Surulere, the Lying-in-State was held at the Holy Trinity Anglican Church, Ikate, thereafter the funeral service was held at the same Church.

After the service, Mama’s body was laid to rest at Ikoyi Private Vaults, Ikoyi, Lagos.

The guests were treated to a sumptuous meal at the prestigious The Jewel Aeida Place on Hakeem Dickson Road, Lekki Lagos. Demola Olota was on the band-stand and thrilled the guests with lovely melodies.

Among the powerful guests are, Founded, Tastee Fried Chicken, Mrs. Olayinka Pamela Adedayo; Philanthropist, Apostle Folorunsho Alakija; Founder of Love of Christ Generation Church, Rev. Esther Ajayi; Senator Olanrewaju Ganiu Solomon; Ace Comedian, Ali Baba; Mrs Adeola Azeez and host of others.

Mama Latunji was survived by Children, Grandchildren, Brothers; and Sisters, she was known for her gentleness, love, caring, and wisdom. She was so respected for her numerous contributions to the families of Latunji and Majekodunmi, also the Church of God.

SEE PHOTOS BELOW:

Sports2 weeks ago

Sports2 weeks agoOfili: ‘Nigeria doesn’t deserve you’ – Fans react as athlete switches allegiance to Turkey

News2 weeks ago

News2 weeks agoUS Back Out: Angry Trump withdraws support for Israel, issues fresh warning, “Do not drop those bombs”

Sports2 weeks ago

Sports2 weeks ago‘Don’t sign him, he doesn’t follow instructions’ — Club warned against signing Super Eagles star

Spotlights2 weeks ago

Spotlights2 weeks agoNo More War: US plots Donald Trump impeachment over unauthorized Iran bombing

Spotlights2 weeks ago

Spotlights2 weeks agoAtiku sidelined again as ADA picks Presidential Flagbearer

Politics1 week ago

Politics1 week agoFresh crisis hits coalition as El-Rufai, Obi may pull out over Atiku’s silence game

Politics2 weeks ago

Politics2 weeks ago2027: Shettima fights back over plot to drop him as Vice President; crisis hits APC